Is it really the most wonderful time of the year if you actually can't afford it?

Roughly 44% of Americans rack up at least $1,000 of holiday debt each year, unfortunately. Most of us love Christmas, but fail to prepare for it.

What if you didn't have any financial stress during the holidays and could afford gifts, activities, meals, and more without having to swipe your credit card or take out a loan?

What if you had an accountability guidebook to help you ensure you found and saved enough money to pay for the entire holiday season in cash?

Would you be up for the challenge?

This year will mark my 6th debt free christmas so yes, it's possible for you too

The holiday season is one of the most expensive times of the year. Plus, the season flies by fast.

If you aren’t prepared financially, you’ll spend all your time and energy worrying about how you’re going to pay for things.

Instead, you could be enjoying time with your family and creating lasting memories.

If you feel like you’re just spinning your wheels and barely making it to the finish line each December, it’s most likely time for a change and to get on a plan.

the Debt Free Christmas Challenge Workbook Can Help You:

- Start planning for expected and unexpected expenses in advance

- Organize your Christmas gift lists

- Track your savings (and find more REAL ways to save)

- Narrow down your budget

- Uncover joy in the holidays instead of debt

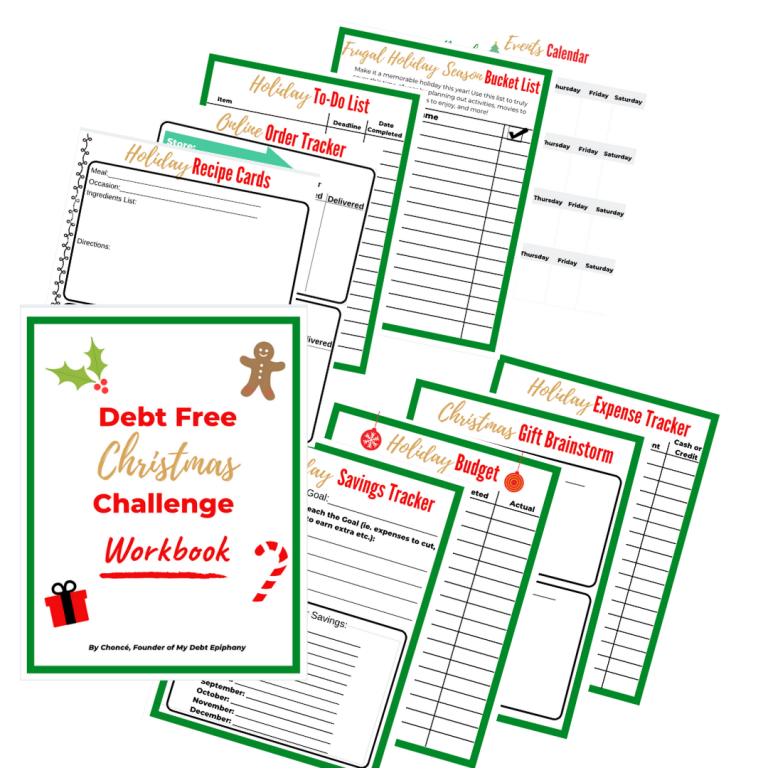

Here's What Comes In Your 15-Page Workbook

- Holiday Savings Tracker Worksheet

- Holiday Budget Sheet

- Holiday Expense Tracker Sheet

- Christmas Gift Brainstorm Worksheets

- Frugal Holiday Season Bucket List

- Holiday To-Do List

- Event Calendars For November and December

-

Online Oder Trackers

- Holiday Recipe Cards

6 Reasons Why You Need to Take the Debt-Free Christmas Challenge Challenge

1. You’re tired of never having enough money when the holiday season rolls in.

2. You’d rather not work countless hours of overtime and side hustle like crazy just to afford Christmas.

3. You’re tired of feeling completely broke and defeated when January comes around.

4. The busyness of December often makes you feel like you never have time to truly enjoy this time of year.

5. You’re ready to get back to the basics and focus on what truly matters.

6. You want to have the peace of mind that comes with knowing every gift and holiday purchase was paid for with cash that you had gathered ahead of time.

Hey, My name is Choncé!

Christmas is one of my favorite holidays but it used to cause me so much stress because I often ran out of money before December 25th.

In 2013, I gave my son a HUGE Christmas and when his smile faded away after opening gifts, I was left with credit card bills and a low bank account balance.

I had to rush back to work during Christmas break to make more money leaving me little time to relax with my family and watch my son enjoy his gifts. It was that year that I said NEVER again and I devised a plan to help me save up for Christmas throughout the year and plan my budget along with my activities .

I created the Debt-Free Holiday Christmas Challenge Workbook to help you maximize your finances during the holiday season. There’s no reason why you can’t cover Christmas without debt and truly savor the most wonderful time of the year!

Frequently Asked Questions

The Aggressive Financial Goal Workbook is a digital download. Once you purchase the workbook, you will receive a link where you can download it along with the free ebook.

Once you purchase the Aggressive Financial Goal workbook, you’ll have unlimited access to the worksheets along with the e-book, Become Your Own Accountability Partner.

Yes! You can pay with a credit card or PayPal below. It’s just as safe as buying anything else online. (I use a secure third party payment processor.)

Challenge Yourself to Make it the Best Christmas Yet

Download the workbook today for only $7!

© My Debt Epiphany 2019