Wow what a month! March was a month of changes and a pretty standard month in terms of finances. Every month I share how well my spending went according to my budget and acknowledge my highs and lows for the month. I’ve been thinking that this may be one of the last reviews I’ll post since I’m getting married in May and I imagine it will be a huge adjustment to combine finances and work out a joint budget.

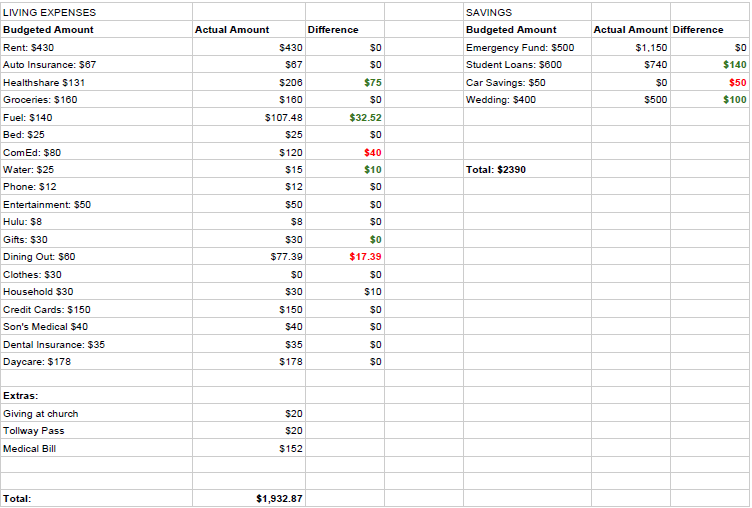

I made some progress on my wedding planning to-do list, had a great Easter at my mom’s house, and spent some quality time with my son for his spring break. This past weekend we went took my son and brother to LegoLand which was super fun. I had almost as much fun as the kids did checking out all the attractions and included some pictures below of the awesome Lego city of Chicago display. Even though it’s technically April, I paid for our tickets in March so the spending is reflected in this month’s review. I am spending a little more than I show on the spreadsheet below for wedding expenses each month, but since I deposit money to a wedding savings account each month and place it on the savings side of my budget, I don’t think I should account for it twice when I spend it. Plus, I plan on sharing a big wedding budget review later to see how we did with keeping our spending under control.

My Highs

My Lows

Onto the Budget

How was your month? Any wins or surprise expenses?

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.

Medical bills suck! I know first-hand. But congratulations on putting so much towards your student loans and savings.

Thanks Aliyyah! Yes they do suck and hopefully I figure out what’s going on.

Grrr, what’s up with those unexpected medical bills?!? I’m glad to see the rest of the month went pretty well though!

I’m thankful for my health but they can keep those bills, haha. I’ll get to the bottom of it.

Medical bills are such crap. My hospital had the nerve to recently send me a $25 bill that is over a YEAR old because they obviously forgot to charge me and were probably doing their books. I called them and told them where they could shove that bill and told them they should have a better accounting department. I know it’s only $25, but I have a huge medical loan with them already where they put all my bills together. They let it go because I raised h*ll, ha!

That’s lame! That sounds like how I handle things sometimes haha.

Thx for sharing your budget! I am a big Budgeter as well. I have been slowly trying to cut things back but we live in a VHCOL area (NYC) so it’s hard but doable.

Thanks for stopping by! I bet, that does sound tough living in NYC, but I’m sure you just have to find a creative way to do it.